The Old Way is Broken

The FundCore Advantage

Everything you need.

Nothing you don't.

We stripped away the bloat of legacy systems to focus on the four pillars of modern fund management.

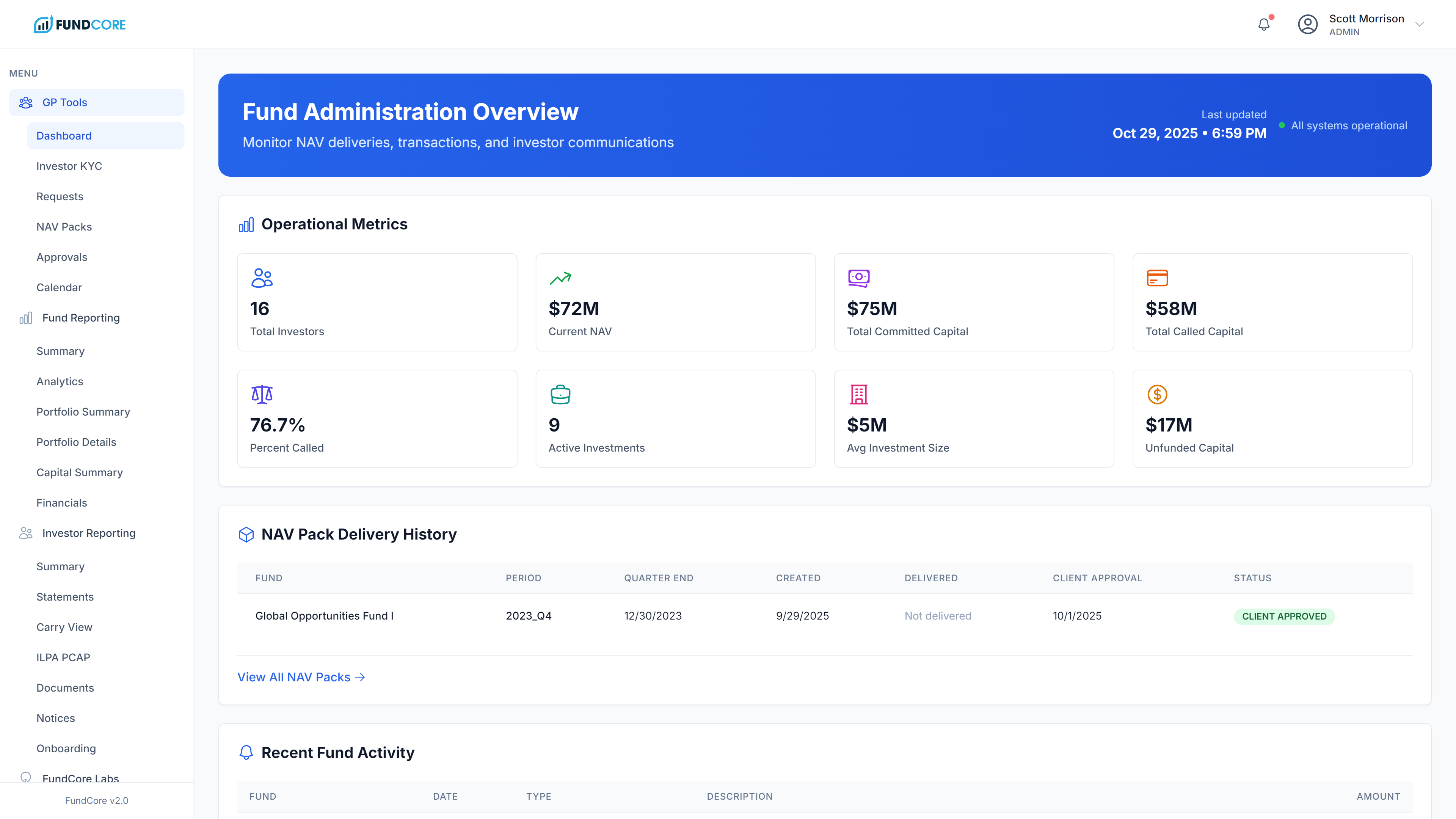

GP Command Center

Complete Operational Control

Ditch the spreadsheets. Manage capital calls, track NAV, and monitor portfolio health from a single, real-time dashboard.

See it live

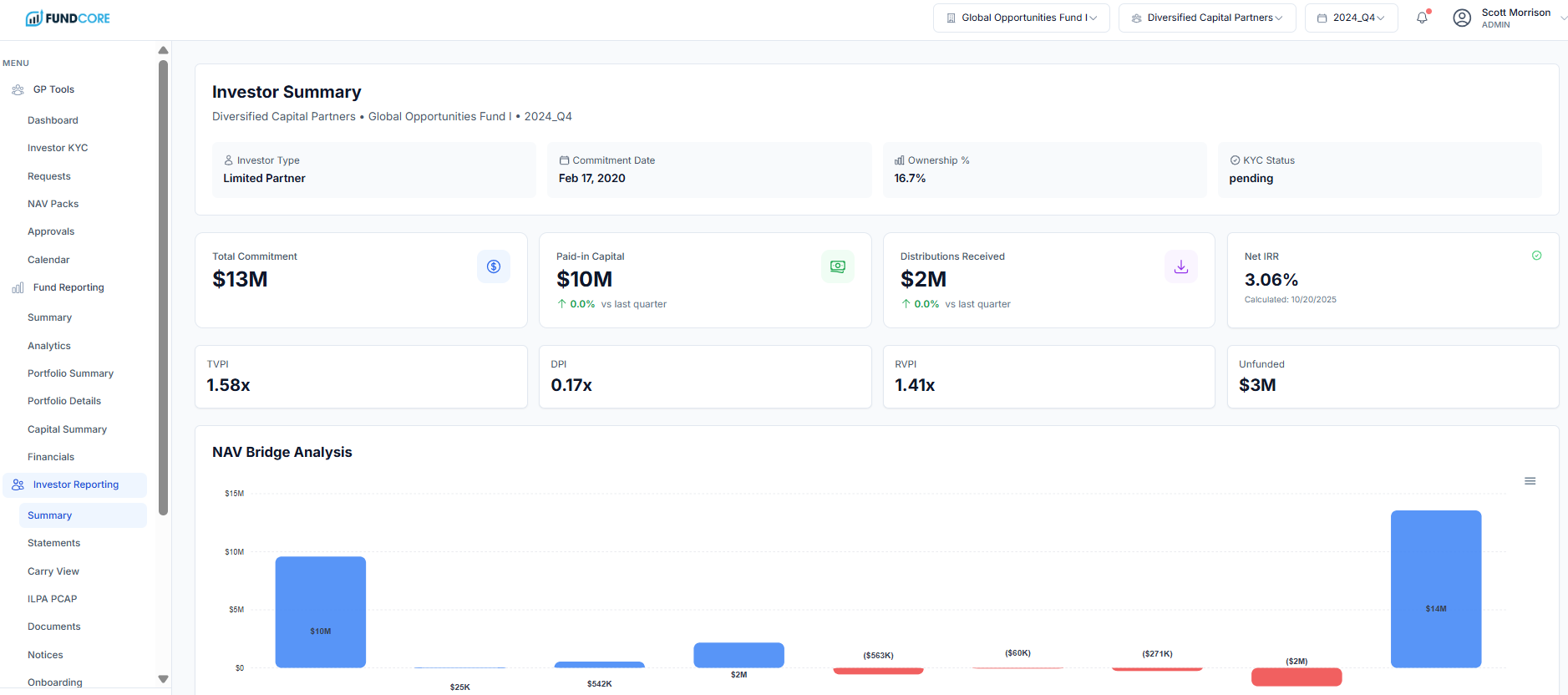

Investor Portal

Institutional-Grade Experience

Give LPs what they actually want: a self-service portal for statements, performance data, and subscription documents.

See it live

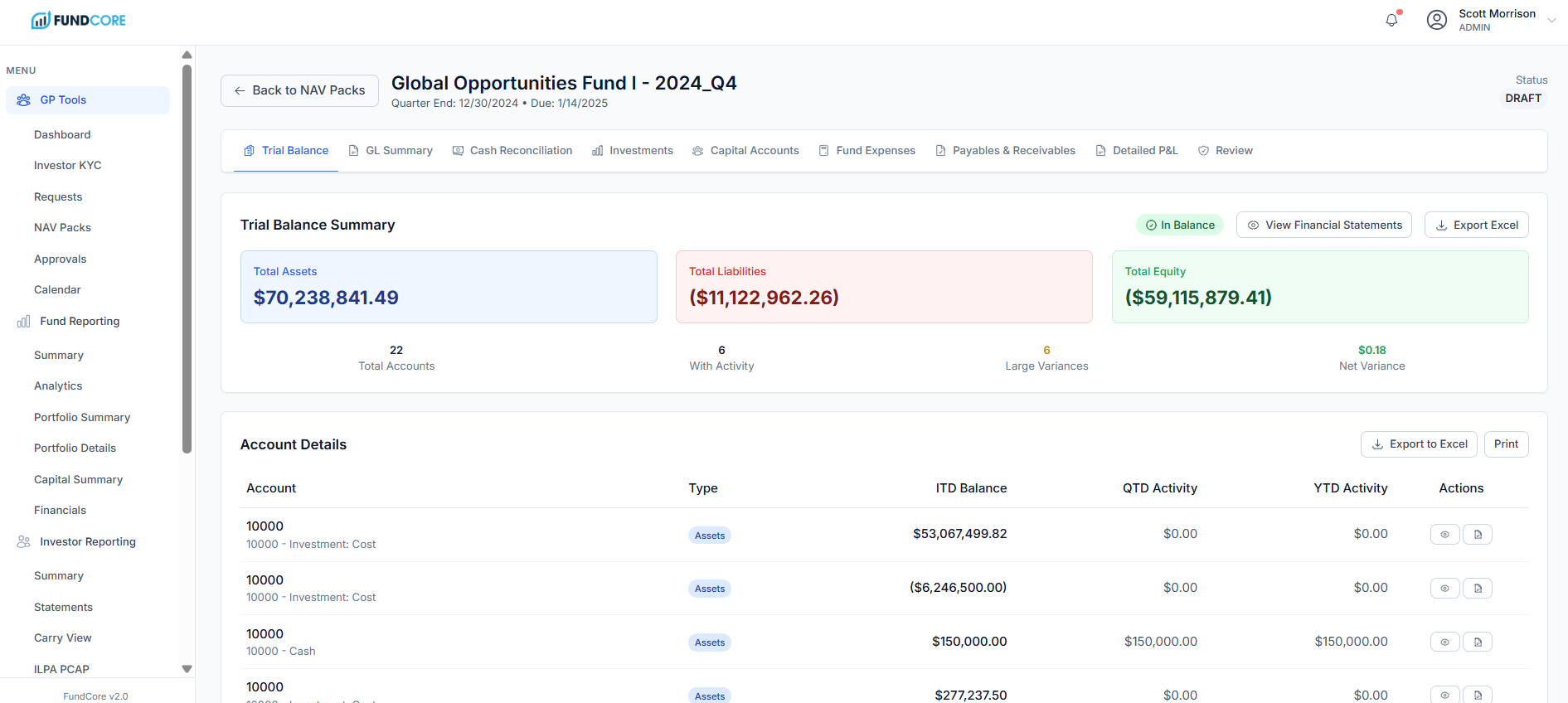

Real-Time Reporting

Days, Not Weeks

Stop waiting for quarter-end. Generate GAAP-compliant financial statements and NAV packs with a single click.

See it live

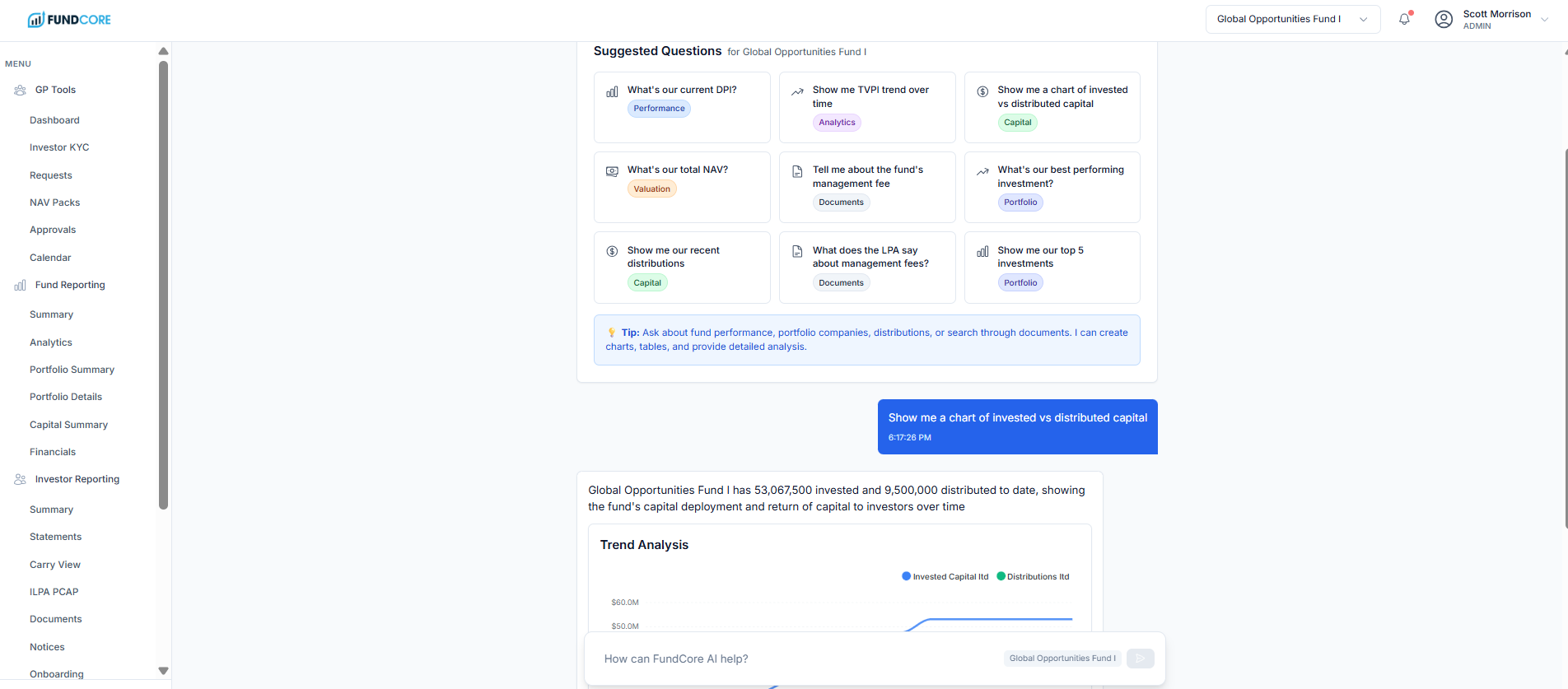

FundChat AI

Your 24/7 Analyst

Query your fund documents in plain English. 'What was Q3 IRR?' 'Show me the LPA distribution clause.' Instant answers.

See it live

Built for LP Due Diligence

Your data is protected by AES-256 encryption, role-based access controls, and strict tenant isolation. We use SOC 2 compliant infrastructure and undergo regular third-party security audits.